Breaking News! New Tax being proposed for Families and Family Businesses

Call to Action!

Contact your member of Congress! Tell them NOT not to impose a net investment income tax on non passive business income

Contact your member of Congress! Tell them NOT not to impose a net investment income tax on non passive business income

Several worrying details emerged on potential tax increases that may be included in any upcoming Reconciliation Agreement that could affect family businesses.

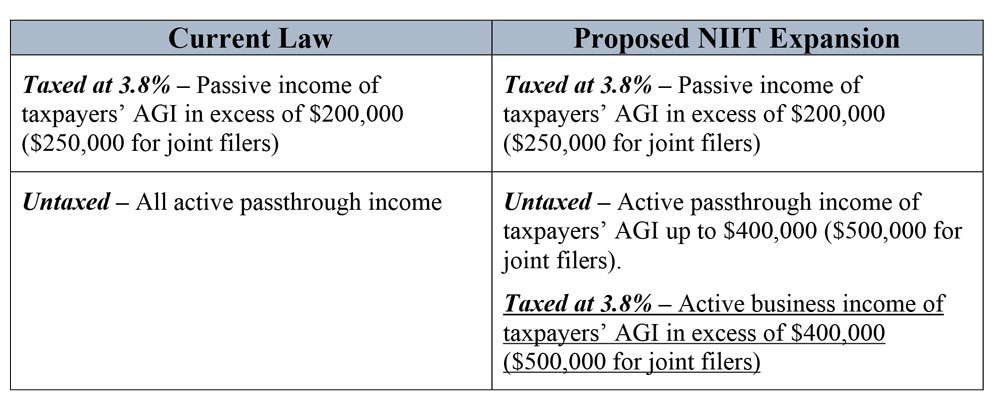

One such proposal that has received significant coverage is an expansion of the Net Investment Income Tax (NIIT), which has the potential to increase taxes on thousands of family-owned businesses across the country!

This NIIT expansion would significantly raise taxes on thousands of small, medium, and large businesses operating as passthrough entities, (which 79% of family businesses do), as an additional 3.8% income tax!

Contact your member(s) of Congress using this form below!

Tell them NOT to impose a net investment income tax on non passive business income!